快速查題-ACCA英國注冊會計師試題

ACCA英國注冊會計師

篩選結果

共找出20題

- 不限題型

- 不定項選擇題

- 單選題

- 填空題

- 材料題

- 簡答題

- 論述題

Which one of the following would help a company with high gearing to reduce its gearing ratio?

A company's gross profit as a percentage of sales increased from 24% in the year ended 31 December 20X1 to 27% in the

year ended 31 December 20X2.

Which of the following events is most likely to have caused the increase?

?Which of the following transactions would result in an increase in capital employed?

From the following information regarding the year to 31 August 20X6, what is the accounts payable payment period? You

should calculate the ratio using purchases as the denominator.

$

Sales?43,000

Cost of sales?32,500

Opening inventory?6,000

Closing inventory?3,800

Trade accounts payable at 31 August 20X6?4,750

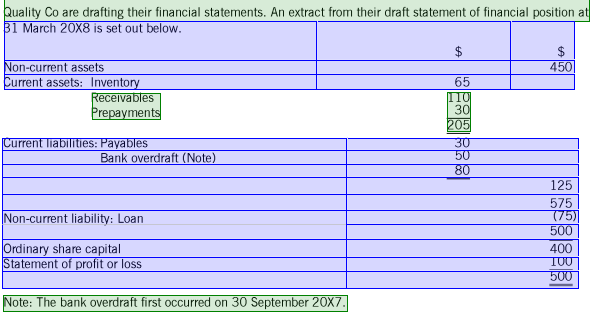

What is the gearing of the company? You should calculate gearing using capital employed as the denominator.

What is the quick ratio of the company?

What is the current ratio of the company?

Which of the following is a ratio which is used to measure how much a business owes in relation to its??size???

A business operates on a gross profit margin of 331/3%. were $680.??Gross profit on a sale was $800, and expenses

What is the net profit margin???

?A company has the following details extracted from its statement of financial position:

??????????????????????????????????? $'000

Inventories????????????? ??? 1,900

Receivables??????????????? 1,000

Bank overdraft??????????? 100

Payables?????????????????????1,000

The industry the company operates in has a current ratio norm of 1.8. Companies who manage liquidity well in this industry

have a current ratio lower than the norm.

Which of the following statements accurately describes the company’s liquidity position?